In a week, it could all be different. Your financial life, how you deal with money, your ability to increase your earning potential and finally getting started with investing because you know just HOW to.

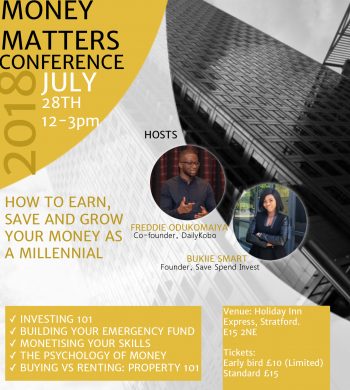

This and much more including buying a property and saving for an emergency fund will be talked about at the Money Matters Conference happening NEXT WEEK SATURDAY, JULY 28TH, 2018. This 3 hour intensive workshop and seminar happening in London will have you feeling confident about how to earn, save and grow your money for the rest of the year.